As we have discussed earlier , CustID is unique to identify the all accounts of a Customer , in this series we will discuss in details :

For Creating Profile of New Customer:

| |

Menu Option

|

CUMM

|

Go to Menu option and enter option CUMM

Function: A (Add)

This will open the General Details (G) option where you have to enter all the information relates to a Customer .

Fill in all details of above first screen i.e

( Customer Name, Shortname ,Type , Status As on ( Ctrl+X for current Date) , Group, Gender, Occupation, Constitution, Staff ( If yes Staff No /Employee ID) Minor , Trade Finacle Customer ( Default N) Introducer Name , Status , Date of Birth of Customer , Nat ID ( Optional as its customized for Banks , AADHAR NO in India, SSN no in USA ,your Country's Citizenship No /Social Security No), Martial Status )

Then press F6 , it will take to next screen

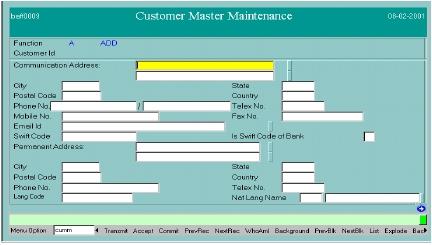

Fill in Communication or Permanent Address of above second screen . Here you might have to enter Mobile no compulsory if your Banks implements SMS alert Service for Customers , it picks the Mobile numer from this Field

Then Press F6 which will take to next which contains Employer Address. If applicable fill in the same properly and Press F6

As shown above in this screen you have to enter details of Community, Caste, Health Code, Tax Slab ( as set by your Bank) and PAN / GIR details etc. and Press F6 which will take you to next screen .

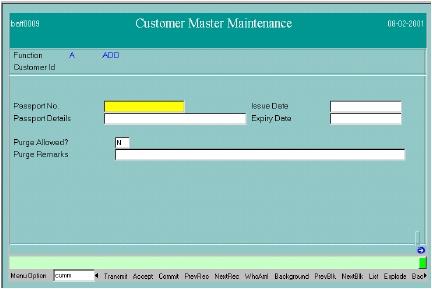

here you enter the financial details, customer net worth if applicable and Press F6 and enter the details such as Passport Details in next screen as shown under :

After entering Passport details if applicable , press F6 which will take you to Free Texts Screen as shown :

As shown above 15 Free Text field are there , here you have to enter Free Text as defined by your banks ( For example few banks use Regular Free text to denotes account is regular , Some uses Yes/ No for Pass sheet/ Passbook Printing , so refer to your Bank's IT/ System Deptt. for these Codes)

press F6 to go on to next page which contains 10 Free Codes , enter free Codes as defined by your Bank , if not defined by your Bank , leave them blank.

Press F6 the system will take you over to the very first page of the customer master maintenance.

Press F4; the cursor will be placed at Enter Option Bloc. Press F2 , the system shall display the list of various options available and select E ( Customer Currency Details ) by pressing Shift+F4. The system shall display the following screen:

Type INR ( if Your Country is India , it will be INR , for Dollar enter USD else Press F2 for other Currency such EURO , etc ) and explode by Control + E. The following screen appears:

If the customer wants to open his account in multiple currency then another currency can be added to his customer master. For adding another currency Press Down Arrow Key , the star (*) appearing just before the Currency already entered, will come down and second currency can be entered in the currency column or can be selected from the list, which appears by pressing F2, and selecting it by pressing Shift+F4 key.

Following four fields are displayed:

1) Withholding Tax % (by default it is 0.0000)

2) Floor Limit for With Holding Tax (this is also 0.00 by default)

3) Customer Preferential % (Cr.)4) Customer Preferential % (Dr.)

Fields 1 & 2 may be filled with 0 (zero). Fields 3 & 4 may be left blank.Field 1 and 2 are not to be changed and shall remain as it is. In case of 3 & 4provided for Customer Preferential % Credit and Debit any +/- rate of interest can be given which will provide extra or less interest in case of Cr. and charge extra or less interest in case of Dr. in all his accounts opened in this customer_id.However, these fields are also not required to be filled in and shall remain unchanged.

In case the customer is neither Minor nor NRE nor Trade Finance Customer Press F10

for final commit, else proceed to enter the details as under:

Case : Minor Customer ( As defined by Banking Laws in each Country)

If customer is a minor Enter Option - M and Press F4. Following screen will appear:

Input the Minor Details such as ( Date of Birth , Gender , Guardian Name & Addresss details) and Press F4

Case : Trade Finance Customer

If the customer is a Trade Finance Customer, Enter option T in the option block and Press F4. Following screen appears:

Enter the details of Trade Finance Customer ( Name, Address, City, State, Country

will appear by default) . Enter Telephone FAX and Telex ,)

If the customer is an NRI ( Non - Resident Indian ) Customer ENTER N in the option block, This Applicable to Banks in India Only and Press F4.

Press F10 to finally Commit

Customer ID will be generated and displayed on the screen as below:

Note down customer ID on the Account Opening Form and send the form for

verification:

For Verification of Customer ID

| |

Menu Option

|

CUMM

|

Function: V (verify), press Tab or Enter Key,

enter Customer_id generated by the system or Press F2 the system shall display list of all the customer_id created/modified pending for verification, select the customer_id (which is to be verified) by pressing Shift+F4. Press F4, the system shall display the particulars of the customer entered in General Details.Press F6, the system shall display the next page. Visit all the 7 pages of General Details by pressing F6 (six times) and check the details entered by the user.When F6 is pressed for 7 th time the system shall display the first page of General Details. Press F4, the cursor shall blink at the option block

Visit Currency Details by entering E at the option block and then by pressing F4 Explode the currency screen by pressing Ctrl+E. Press F4 twice, the cursorshall blink at the option block again.If no other details are entered, press F10 to commit. The system shall display the message ‘ Record Verified’ , which effectively means that the cust_id is verified

Following options need to be visited, during verification, for the Minor, NRE, and Trade Finance Customers.

a) In case of Minor , capture G, E and M details before verification.

b) In case of Non Resident Customer, capture G, E and N details before verification.

c) In case of Trade Finance Customer, capture G, E, T, U (if applicable)details before verification.

d) P (Persons Details) can be captured wherever required.The Customer Creation and Verification is thus complete

Other Functions in CUMM:

Purpose

|

Menu Option

|

Function

|

For Modification in CID

|

CUMM

|

M

|

For Cancel Created CID

(Only possible before verification)

|

CUMM

|

X

|

For Copying details of an existing

Cust. ID

|

CUMM

|

C

|

For Suspension of CID

|

CUMM

|

D

|

For Revoking Suspension

|

CUMM

|

U

|

Hope this post will help you while dealing with Creating Customer ID for Opening accounts . Feel Free to post your feedback and suggestion.

Please provide list of codes used in ever box and frames.

ReplyDeleteHow can find interest to be paid pn term deposit easly

ReplyDeleteYOU CAN FIND INTEREST DETAILS IN ACLI

DeleteBY TYPING /C NO.AND PRESSING CTRL+E

AND USING OPTIN ? IN ACLI

PLEASE VISIT

https://finaclecommand.blogspot.in/2017/03/FIND-CUSTOMER-ID-OF-AN-ACCOUNT-THROUGH-ACLI.html

awesome......thanks:)

ReplyDeleteHow to create cumm id in bulk for more number of customers

ReplyDeleteHow to remove pan from cust id

ReplyDeleteHow to verify cumm if you are not bh/abh

ReplyDeletePirpose of health code in cumm.

ReplyDeleteWhere to enter CIN NO OF comapny in cumm

ReplyDelete